The Rule Of 40 Formula Is Growth

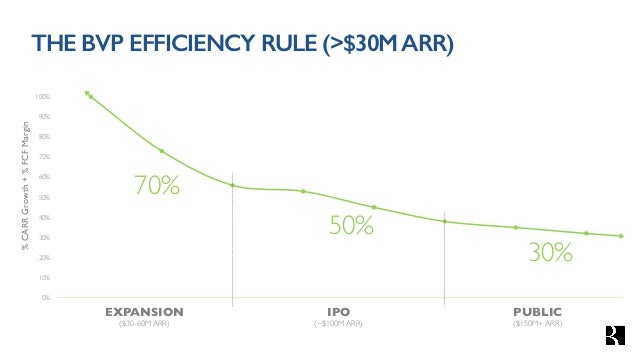

The Rule of 40 works well when growth rates aren’t very high. For early stage companies which typically grow 3–5x YoY, this rule breaks down dramatically. Directionally, the rule is correct. The 40/70 rule is a two-part approach to decision-making. Powell begins by stating that you need to have enough information to make an informed decision but not so much that you risk the decisiveness to stay abreast of the situation. But his 40/70 rule is actually comprised of two parts. Enter the Rule of 40! If this is the first time you’re hearing about the Rule of 40, this financial framework helps you weigh up your revenue growth against your margins. Using this framework, you can: Understand the trade off between growth and profitability; Benchmark the health of your SaaS company,.

If you're just getting into investing and fast math isn't your strong point, you can quickly see how long it will take to triple your investment with the rule of 115.

When determining how long it will take to double your investment quickly, you would use the rule of 72. All you need to do is divide the number 72 by your projected growth rate. If you want to know how long it would take to triple it however, Andy Kiersz at Business Insider suggests you use 115 instead. For example, if you're getting a return of 5%, you would divide 115 by 5, telling you that your investment will triple in 23 years. Both the rule of 72 and the rule of 115 work because they're just manipulating the formula for calculating compound interest. Neither rule will provide precise results, but it will give you an idea of how long you're looking at. It's also important to consider inflation and other factors, but this is more a quick trick and not a guaranteed accurate number.

Advertisement

7 Math Tricks That'll Make Your Life Easier Business Insider War thunder dev server download.

Photo by Chris Potter.

Advertisement

Understand the exponential growth rate formula. If you start with an initial amount

Understand the exponential growth rate formula. If you start with an initial amount The Rule Of 40 Formula Is Growth Fund

that grows exponentially, the final amountThe 40 Percent Rule

is described by the formula . The variable r represents the growth rate per time period (as a decimal), and t is the number of time periods.

is described by the formula . The variable r represents the growth rate per time period (as a decimal), and t is the number of time periods.The Rule Of 40 Formula Is Growth Rate

- To make sense of this formula, picture a $100 investment with a 0.02 annual interest rate. Every time you calculate growth, you multiply the amount you have by 1.02. After one year, that's ($100)(1.02), after two years that's ($100)(1.02)(1.02), and so on. This simplifies to , where t is the number of time periods.

- Note: If r and t do not use the same time unit, use the formula , where n is the number of times growth is calculated per time period. For example, if r = 0.05 per month and t = 4 years, use n = 12, since there are twelve months in a year.